The average credit score in the U.S. remained steady at 715 at the end of 2024, according to Experian data. But while stability has been the trend, recent developments suggest that credit scores could face new pressures in the coming months.

Banks, landlords, credit card issuers, employers, and utility providers all use credit scores to assess how likely someone is to make timely payments. A strong score usually leads to better loan terms and lower interest rates.

However, a weak score can limit access to credit.

One major change is the decision by scoring giant FICO to incorporate Buy Now, Pay Later (BNPL) data into its scoring system. BNPL allows consumers to purchase items immediately and pay for them over time, typically in interest-free installments if payments are made on schedule.

While this offers flexibility at checkout, financial experts warn that multiple BNPL plans can lead to overspending and debt, if consumers fail to track repayments carefully.

Meanwhile, student loan reporting has resumed after a pause during the COVID‑19 pandemic. Federal student loan payments were suspended for several years, and missed payments were largely not reported to credit bureaus during that period.

As the reporting “on‑ramp” ended in October 2024, newly missed payments and delinquencies began affecting credit scores again. By February 2025, these changes contributed to the average FICO score remaining around 715, but with significant individual declines.

More than two million borrowers saw drops of 100 points or more in the first quarter of 2025, and over one million lost 150 points or more, according to The Federal Reserve Bank of New York. Those with higher starting scores were typically hit hardest, though borrowers with lower scores also experienced decreases.

The share of the population with a delinquency of 90 days or more in the past six months rose from 7.4 percent in January 2025 to 8.3 percent in February 2025, an increase of 12 percent, following the restart of student loan delinquency reporting, FICO shared earlier this year.

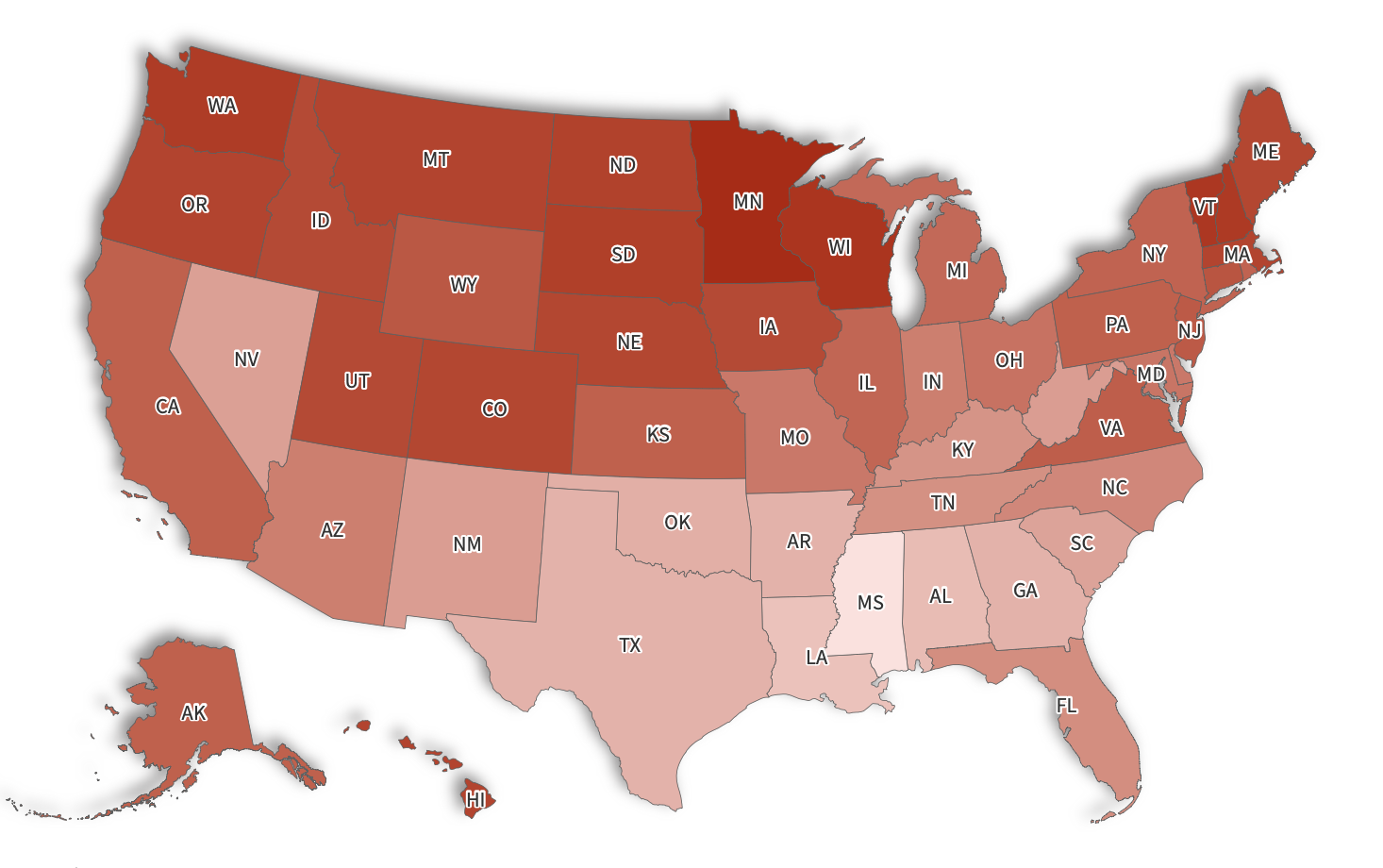

State Credit Scores

In 2024, the states with the highest average credit scores were Wisconsin at 738, followed closely by Vermont with 737, New Hampshire at 736, Washington at 735, and North Dakota with 733.

At the other end of the spectrum, the lowest average scores were found in Mississippi at 680, Louisiana at 690, Alabama with 692, Arkansas at 695, and both Georgia and Texas tied at 695. Most of the state’s with the poorer average credit scores are concentrated in the South.

While most Americans maintain scores within the “good” range, upcoming reporting changes and the growing adoption of BNPL services into credit metrics could shift the landscape in 2025 and beyond.