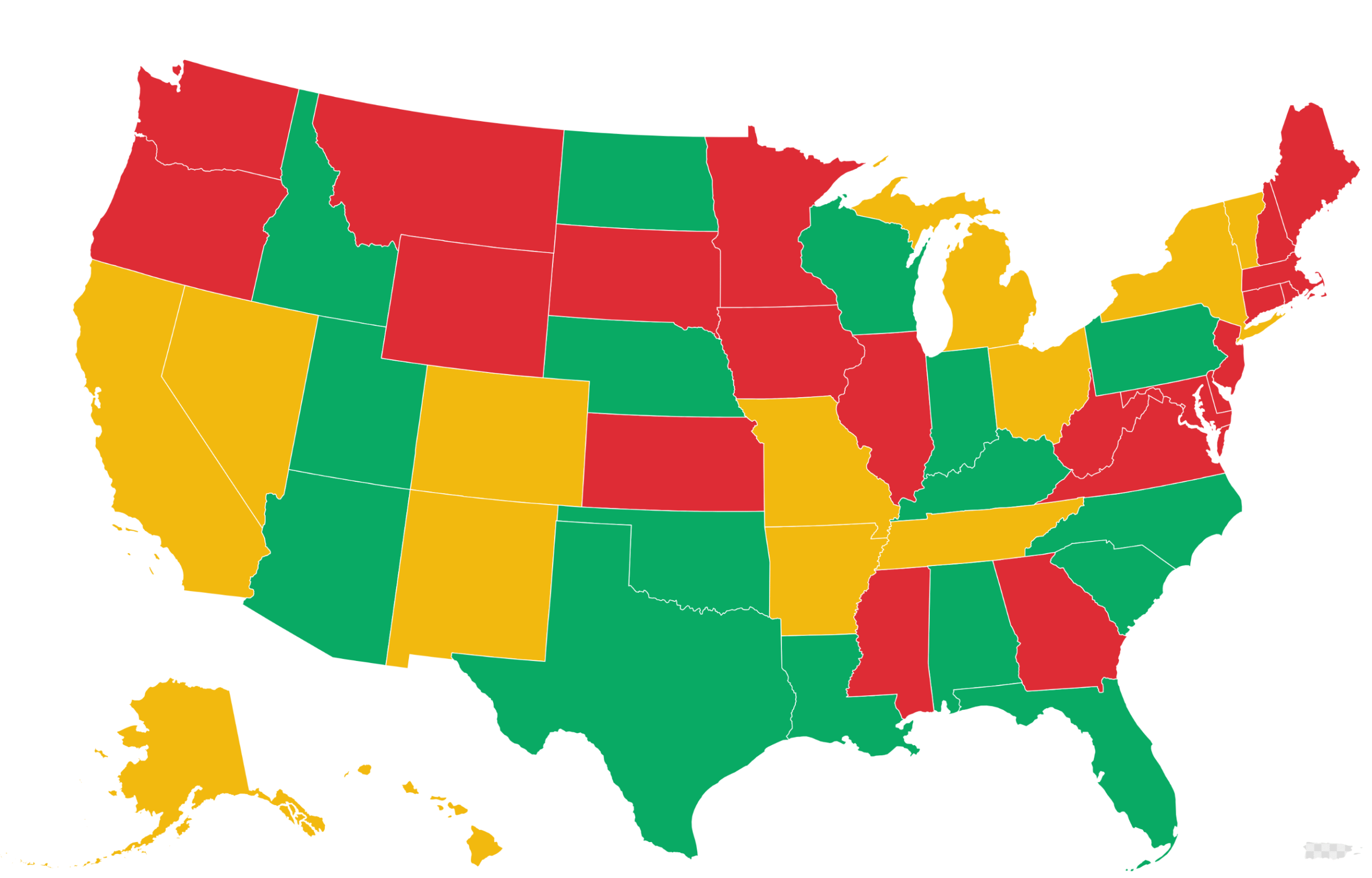

A number of states are especially susceptible to, or have already slipped into, an economic downturn, according to Moody’s Analytics Chief Economist Mark Zandi.

“Based on my assessment of various data, states making up nearly a third of U.S. GDP are either in or at high risk of recession,” Zandi posted to X on Sunday. “Another third are just holding steady, and the remaining third are growing.”

Why It Matters

Zandi has been one of the leading economic voices issuing warnings about the current state and trajectory of the U.S. economy. Earlier this month, he stated that the entire economy was on the “precipice of recession,” as evidenced by recent data on spending, employment and manufacturing. These concerns have been largely driven by tariffs—which he has described as “cutting increasingly deeply into the profits of American companies”—but also by sustained weakness in the U.S. housing market.

What To Know

According to Zandi’s analysis, 21 states and the District of Columbia are currently either in a recession or at high risk of entering one. Zandi categorizes 13 state economies as “treading water,” and 16 as growing. He noted that New York and California, both bellwethers of the wider economy, were “holding their own.”

Here is a breakdown of Zandi’s lists, in which states have been ranked “from strongest to weakest.”

- Recession/High Risk: Wyoming, Montana, Minnesota, Mississippi, Kansas, Massachusetts, Washington, Georgia, New Hampshire, Maryland, Rhode Island, Illinois, Delaware, Virginia, Oregon, Connecticut, South Dakota, New Jersey, Maine, lowa, West Virginia, District of Columbia.

- Treading Water: Missouri, Ohio, Hawaii, New Mexico, Alaska, New York, Vermont, Arkansas, California, Tennessee, Nevada, Colorado, Michigan.

- Expanding: South Carolina, Idaho, Texas, Oklahoma, North Carolina, Alabama, Kentucky, Florida, Nebraska, Indiana, Louisiana, North Dakota, Arizona, Pennsylvania, Utah, Wisconsin.

In June, the Bureau of Economic Analysis (BEA) reported that GDP had shrunk in 39 states in the first quarter of 2025, as the national economy contracted for the first three-month stretch since early 2022. However, a preliminary estimate released in late July indicated a solid rebound in the second quarter, with GDP growing by a better-than-expected 3 percent on an annualized basis. State-level data will be published alongside the BEA’s final estimate on September 25.

In response to a question regarding his methodology, Zandi told Newsweek that the list was “a subjective assessment based on various coincident measures of economic activity,” including payroll employment and industrial production.

“If the preponderance of these coincident measures is exhibiting a persistent decline then I consider it to be in or at serious risk of recession,” Zandi said, adding that his methodology was employed by the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER).

The most recent industrial production estimates from the Federal Reserve showed a slight decline of 0.1 percent in July, compared to forecasts of a flat reading and 0.4 percent gain in June.

Meanwhile, the latest reading on nonfarm payrolls came in well below expectations, finding that the economy added only 73,000 jobs in July. This, as well as downward revisions to May and June’s data, led to President Donald Trump firing the commissioner of the Bureau of Labor Statistics (BLS).

What People Are Saying

Mark Zandi, chief economist of Moody’s Analytics, posted to X: “States experiencing recessions are spread across the country, but the broader DC area stands out due to government job cuts. Southern states are generally the strongest, but their growth is slowing. California and New York, which together account for over a fifth of U.S. GDP, are holding their own, and their stability is crucial for the national economy to avoid a downturn.”

What Happens Next?

The next key piece of employment data will be the August nonfarm payrolls report from the BLS, scheduled for release alongside the national unemployment rate on Friday, September 5.

Last week, Zandi said that the “machine-learning-based leading recession indicator” used by Moody’s placed the probability of a downturn beginning within the next 12 months at 49 percent.