A national consumer advocacy organization warns that the Total and Permanent Disability (TPD) federal student loan discharge program has become mired in administrative failures after the Department of Education (DOE) shifted processing operations, negatively affecting seniors, veterans and other borrowers with disabilities who are seeking monetary relief from exorbitant costs.

Newsweek reached out via email to the DOE for comment.

Why It Matters

The TPD discharge program provides federal student loan cancellation for borrowers whose disabilities prevent them from sustaining gainful employment, a measure designed to protect medically vulnerable people from debt burdens they could not repay. Congressional action on a bipartisan basis has provided funding for such individuals.

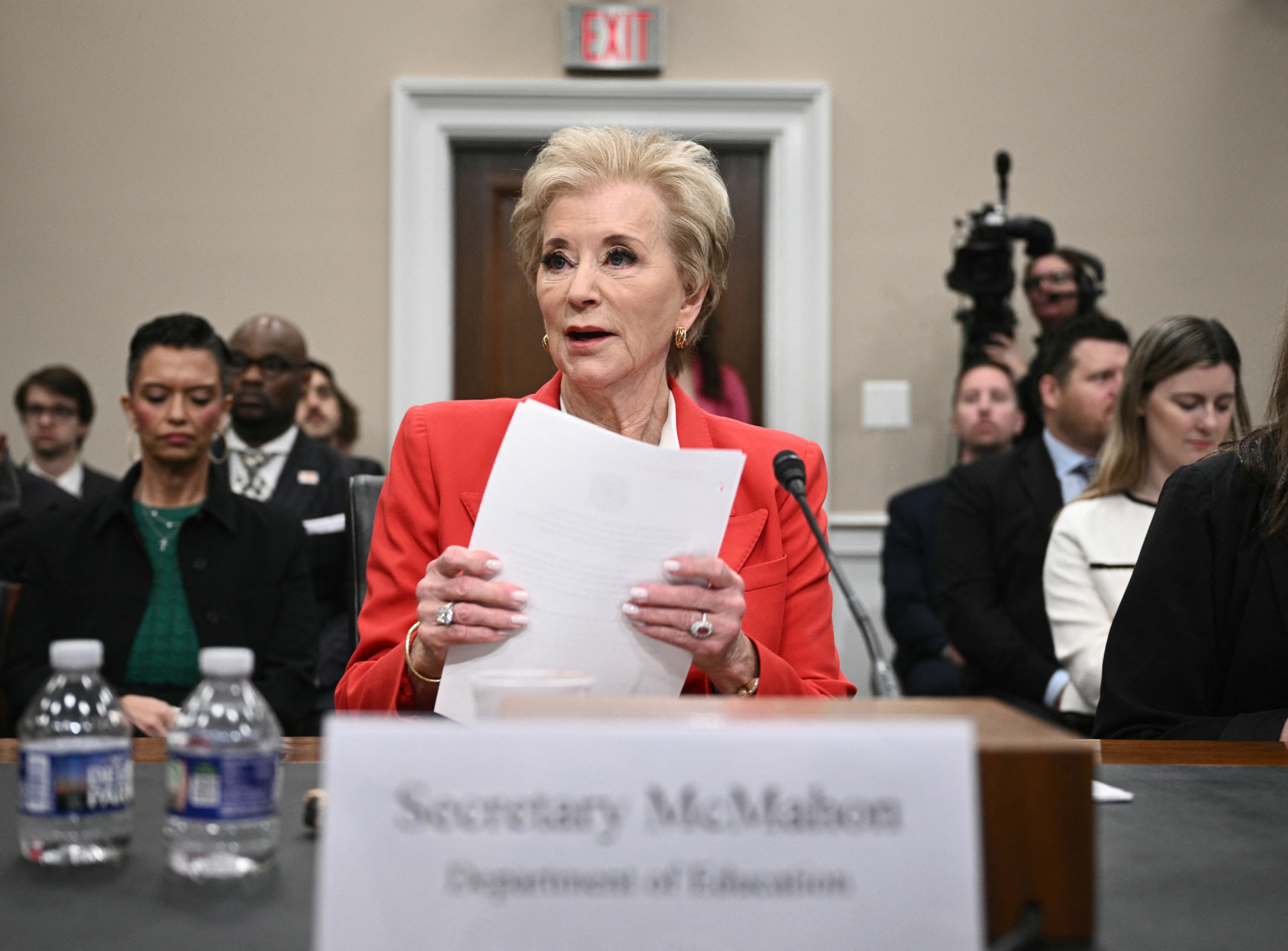

Student loans are currently held by more than 40 million Americans, with an outstanding nationwide balance that exceeds $1.7 trillion. Since President Donald Trump took office again in January, many borrowers have experienced higher monthly payments and a slew of changes that have included changed tax rules and more limited forbearance options when compared to the Biden administration’s efforts to forgive loans for millions.

BRENDAN SMIALOWSKI/AFP via Getty Images

What To Know

The National Consumer Law Center (NCLC), which is seeking swift action on the DOE’s behalf to rectify processing shortcomings that are impacting borrowers’ lives, said in a letter to the DOE in August that for years many eligible borrowers were unable to access relief through the TPD program because of administrative barriers, complex regulatory requirements and an “unnecessarily burdensome application” process that particularly affects disabled veterans—as more than half of those who qualified for a discharge were unable to obtain one.

The Office of Federal Student Aid transitioned TPD processing from contractor Nelnet to a new platform and private contractors early in 2025, with critics saying the change produced a pause in processing that has led to a backlog of applications and continued platform failures that delayed decisions, notifications and servicer forbearance placements.

NCLC credits the first Trump administration, which in 2019 directed the DOE to streamline the TPD process and expedite relief for eligible veterans by establishing a data-matching agreement with the Department of Veterans Affairs (VA) to automate loan discharges for qualifying veterans.

Similarly, in 2021, the DOE entered into an agreement with the Social Security Administration (SSA) to automatically discharge loans for borrowers identified as totally and permanently disabled based on SSA’s data.

Thousands of borrowers with disabilities have received TPD discharges “without having to navigate bureaucratic red tape,” the NCLC wrote.

But worries are heightening as the agreement is set to expire September 30.

Alpha Taylor, an NCLC staff attorney, told Newsweek via phone on Thursday that the center has not yet received a response from the DOE regarding the letter and concerns relayed within.

“Ever since the transition process started, we have received a lot of complaints from our community, from borrowers and advocates, about systematic problems,” Taylor said. “You have a backlog of TPD applications that were submitted before the transition started that still haven’t been processed.

“Additionally, when a borrower submits a complete application, the department is supposed to put the borrower in forbearance—basically stop any sort of a collection they’re required to make…until they come up with a decision on the application. However, the borrowers that have submitted TB application are not being placed in forbearance, at least the borrowers that have reached out to us.”

The TPD discharge program allows borrowers with qualifying disabilities to obtain discharge by meeting one of three pathways listed on the DOE website: documentation from the VA showing 100 percent disability; receipt of Social Security disability benefits meeting specific criteria; or certification from an eligible medical provider that the borrower could not engage in substantial gainful employment.

Taylor said that such borrowers who submit applications are basically hearing nothing from the DOE. In turn, he said it has created “a storm of problems, a storm of delays.”

“These are mostly older borrowers, veteran borrowers who cannot qualify for the TBD treated veteran matching program with the Department of Education,” he said. “We’re also talking about borrowers with terminal illness—folks with brain cancer, folks that are battling medical conditions. Whether it’s a result of a physical or mental disability, they cannot engage in any employment to benefit from the education they may have received.

“These are folks who are already struggling, who are trying to cope with the stress that comes with living with a disability and at the same time just function in their daily lives. And they are being saddled with this huge debt and now the department essentially is not processing applications, is not giving them a decision on the application that have been submitted. It’s really creating anxiety and frustration.”

What People Are Saying

The National Consumer Law Center wrote to the Department of Education on August 21: “Despite the looming deadline, the Department has not indicated whether it intends to renew the agreement or continue processing automatic discharges for eligible SSA beneficiaries beyond that date.

“Failing to renew the TPD data matching agreement with SSA would lead to defaults and extreme and unnecessary financial hardship for many disabled SSA beneficiaries who are unable to work and cannot make student loan payments due to limitations imposed by their disabilities, and whom Congress targeted for relief.”

What Happens Next

The NCLC urged immediate corrective action to remedy the TPD processing failures and restore access for eligible disabled borrowers, recommending congressional oversight if problems persist.