Data released by the Tax Foundation, a nonpartisan, nonprofit tax policy organization, has revealed the states with the highest total gas tax, as well as which states have seen the largest increases since last year.

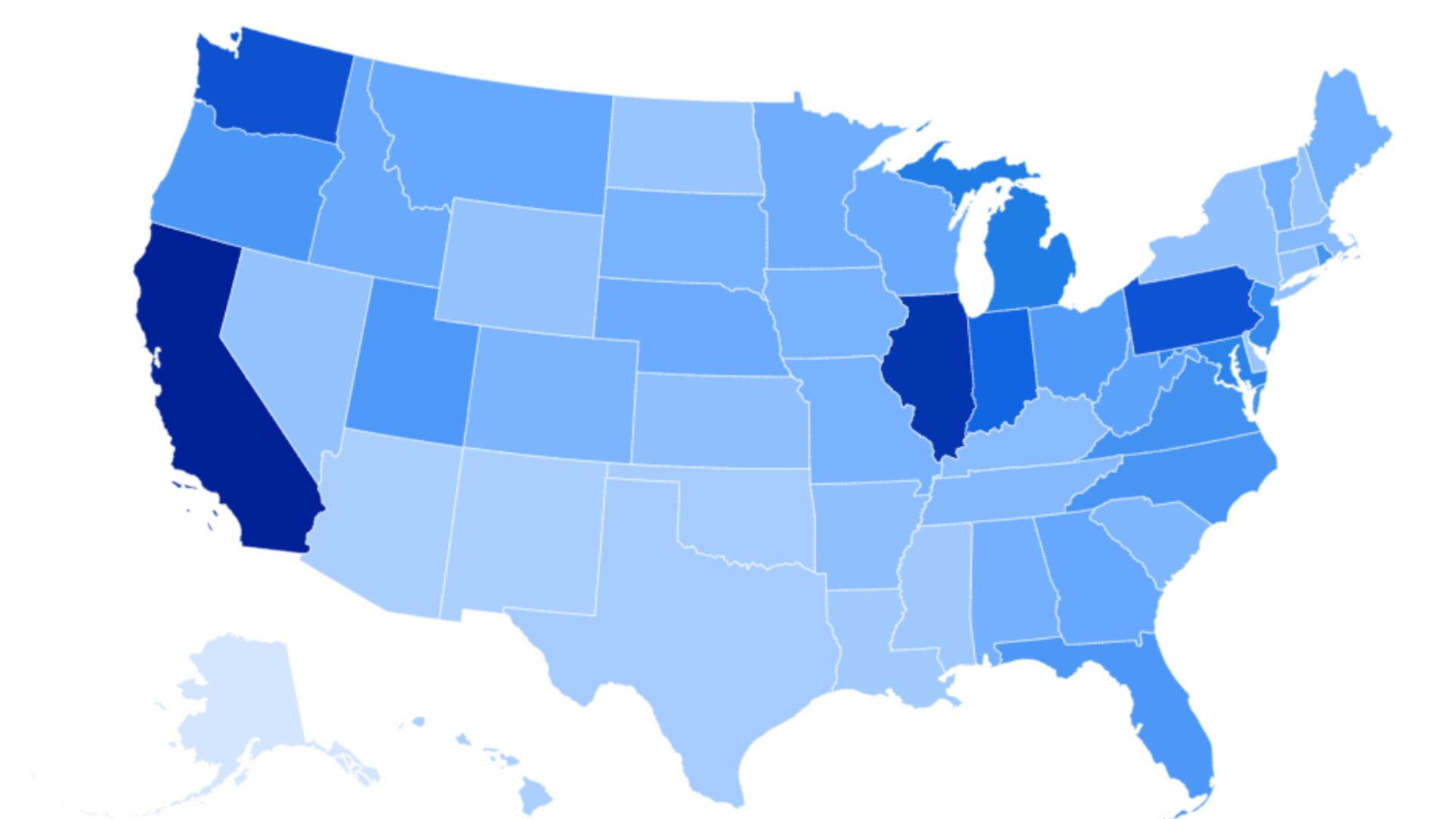

California was the state with the highest gas tax at 70.9 cents per gallon (cpg), followed by Illinois and Washington, with taxes of 66.4 cpg and 59 cpg, respectively.

A number of states have increased their gas taxes this year, with eight states upping costs as of July 1.

Newsweek has contacted the California Governor Gavin Newsom‘s office via email for comment.

Why It Matters

While gas prices have been dropping, allowing many across the country to enjoy much more preferable costs when filling their car with fuel, gas taxes have seen considerable hikes in some states.

According to the Tax Foundation, fuel taxes are typically used to fund the construction and maintenance of roads that drivers use, with the aim of avoiding charging people taxes for things they do not want or use.

While gas taxes can mean drivers enjoy higher quality roads, it can also put financial pressure on those with lower income, particularly in states where these taxes are high.

What To Know

California increased its gas tax in 2017, which was approved by voters in 2018, before Newsom took office. In the state, the revenue generated from gas tax is used to fund transportation projects such as improving highways and roads.

Other states with high gas taxes include Pennsylvania, with a tax of 58.7 cpg, Indiana, with a tax of 54.5 cpg, Michigan, with a tax of 48.2 cpg, Maryland, with a tax of 46.2 cpg, and New Jersey, with a tax of 45 cpg.

Referring specifically to California, Illinois and Washington, Arthur van Benthem, a professor of business economics and public policy at Wharton University of Pennsylvania, told Newsweek “these states use high gas prices to fund major infrastructure projects and environmental programs.”

The lowest gas tax rates are levied in Alaska at 8.95 cpg, followed by Hawaii at 18.5 cpg and New Mexico at 18.9 cpg.

Van Benthem said that these states had the lowest gas tax because, in the case of Alaska, the state “already raises a lot of tax revenue from oil production, so keeps its gas tax low.”

Meanwhile, Hawaii has expensive, imported fuel and “has chosen other taxes to raise revenue,” he said.

“New Mexico wants to keep fuel taxes low because of equity concerns—gas taxes weigh heavily on high-mileage, rural drivers,” he added. “They also receive a lot of federal road infrastructure funding.”

States that saw the largest increases in gas tax included Washington, Missouri and Kentucky – with Missouri and Kentucky each moving up nine spots in the rankings this year.

“Missouri had severe infrastructure funding gaps,” van Benthem said, adding that “Kentucky now has an inflation-adjusted tax that moves with fuel prices, so if fuel prices go higher, so does the tax.”

The Tax Foundation also noted that the data “does not include certain local taxes or the effects of environmental programs and regulations like cap-and-trade carbon policies or low carbon fuel standards, taxes levied at the local level, or certain taxes levied on gross receipts.”

What People Are Saying

Van Benthem told Newsweek: “Estimates suggest that when gas prices double, people will drive 10 to 20 percent less in the medium run. But another important reason to tax gasoline is raising state revenues. The question of who wins and who loses determines how the revenues are spent. High-state taxes invest more in road infrastructure, so tax dollars are indeed at work. Of course, high-mileage drivers will see their gasoline bills rise substantially to enjoy the benefit of better roads.”

Joshua Linn, a professor in the Department of Agricultural and Resource Economics at the University of Maryland, told Newsweek: “Except for households with electric vehicles, higher gasoline taxes cause households to spend more on gasoline. States generally use that tax revenue to fund transportation projects, which can benefit all residents of the state. If states don’t want to raise their gasoline taxes, they would have to raise other taxes or cut other spending to finance those transportation projects.”